Astute ebike owners know there are risks to riding ebikes on city streets alongside cars and through traffic. Unfortunately, your risk while riding is not limited to your own handling of an ebike; there are risks inherent to how others respect and respond to you. With ebikes becoming ubiquitous everywhere, concerned ebike owners have legal and insurance questions regarding their rights and coverage as a cyclist. Too often ebikes can be cited as a “motorized” vehicle in a bike-pedestrian accident but don’t warrant the same coverage as would “motorized” vehicles if a bike battery is damaged or the bike is vandalized or stolen.

Newly emerging niche insurance for ebikes provides coverage for these gaps which helps protect both ebike owners and anyone else who may be injured in an accident.

eBike Insurance: Do I need it?

Short answer: yes.

Longer answer: maybe, but let’s assume yes.

Here are some reasons why:

First, ebikes are expensive.

An inexpensive ebike is around $1500 and a nice one will cost you double that. It makes sense for owners who have spent a respectable chunk of change on their ebike to back it up with insurance that will cover damage, vandalism or theft.

Second, insurance covers damage to your bike

Too often, ebikes are subject to vandalism since they are frequently parked outside in a sidewalk bike rack. People walking by can tinker with the battery, pinch the cables, smash the display unit or do other damage to the bike while you wait for your coffee inside. The unfortunate truth is some people don’t like ebikes and may take a moment to damage yours just out of spite.

Homeowners insurance and vehicle insurance will most likely NOT cover damage to your ebike in these scenarios.

Third, ebike insurance protects you

If you are in an accident due to a crash or impact with another vehicle or pedestrian, you could be injured and need medical coverage and/or bike repair. Again, some homeowners or vehicle insurance policies won’t cover you here, especially if you are at fault.

Fourth, ebike insurance protects others

If you are in an accident, you want to limit your own liability should someone be hurt. Accidents happen to all of us… if you’ve been a cyclist long enough chances are you’ve been in your own scrape-up. It happens. Having ebike insurance can protect you from costs associated with healthcare or treatment needed by others in an accident.

One recent bike-pedestrian accident in London killed a pedestrian and left an e-cyclist with criminal charges since he was riding 10mph over the speed limit and was uninsured and unlicensed at the time of the collision. As more ebikes join pedestrians and cars on the road, more accidents are bound to happen (hopefully not this bad though).

Even if you have a less expensive bike and you only plan to ride recreationally from time to time, having ebike insurance protects your bike, you, and others from damage, accident or injury.

eBike Insurance: How do I get it?

Several existing insurance companies as well as new ebike-specific insurance companies can provide coverage. Call to set up your policy with a broker.

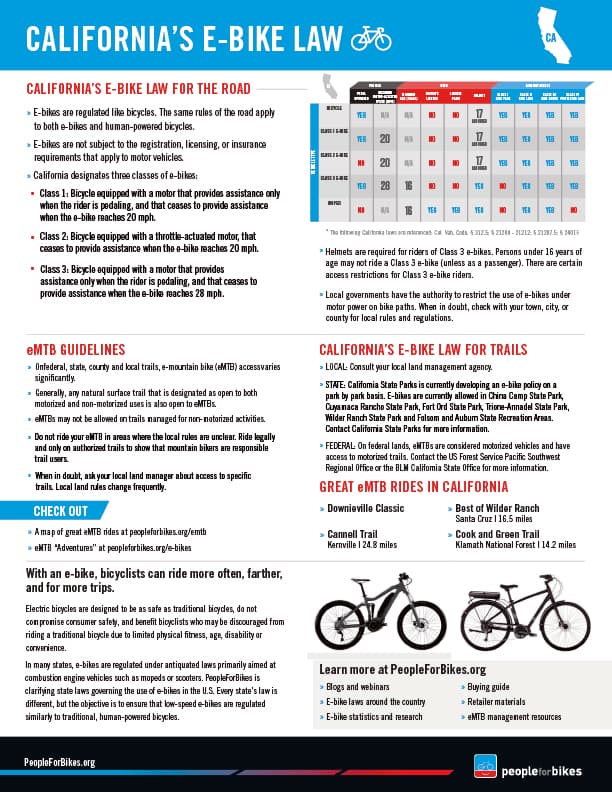

However, local laws will limit what ebikes can be covered by a given policy. For example, in Europe, ebikes will only be covered if they go less than 20mph, the rider is wearing a helmet, and the bike is registered. Make sure to know the make, model, max speed, class and other details about your bike when you set up a policy.

What are my local ebike laws?

We recommend ebike owners learn and abide by local laws that pertain to their area and type of riding. One of the best sources of information for local ebike laws is available from the People for Bikes Organization found here.

This is an example of ebike laws for the state of California:

If you have a bike that doesn’t qualify for ebike insurance because it goes too fast, we highly recommend registering it as a moped and insuring it appropriately.

Ebike insurance companies (not an exhaustive list):

Markel eBike Insurance

Velosurance

McClain Insurance

Spoke Insurance

Pedal Power Insurance

Leave a Reply